Welcome to the Corporations Ontario, where we empower your entrepreneurial journey with our comprehensive, secure, and user-friendly Corporations Ontario and Incorporation Services.

From CRA account registration, corporate seal creation, to minute book preparation, we provide a range of services to help your business stay compliant and organized.

Our Services

The Corporations Ontario offers comprehensive incorporation and business registration services across Canada, including corporate filings and searches. With our efficient process, we can incorporate your business in as little as two business hours.

A corporation is a legal entity that keeps the business owner separate by offering the benefit of limited liability. It also offers lower tax rate, ownership transferability, better access to capital and grants and corporate name protection.

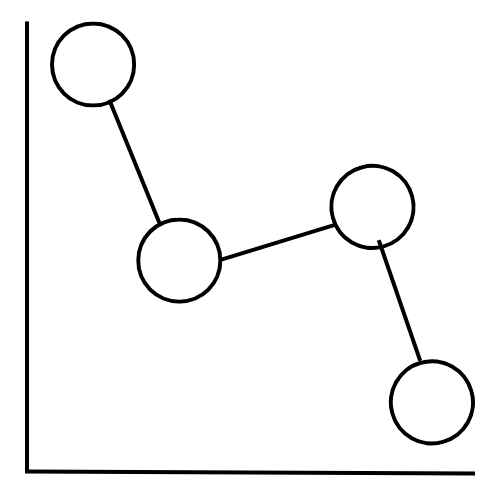

Timeline: A named or numberd company can be incorporated in 2 business hours

If you want the protection of corporate name, apply for trademark in future, then a federal corporation could be a better choice. You may incorporate a federal numbered company or named company.

Timeline: a numbered company can be ready in in 2 hours and named company in 1 day.

A business name registration could be a btetter alternative than incorporation, if you would like to try your business idea before you take serious initiative. This option allows to operate the business legally, but does not optimize the tax.

Timeline: Registering or renewing a business name can be done in 2 hours.

A corporation is a legal entity that keeps the business owner separate by offering the benefit of limited liability. It also offers lower tax rate, ownership transferability, better access to capital and grants and corporate name protection.

Timeline: A named or numberd company can be incorporated in 2 business hours

A corporation is a legal entity that keeps the business owner separate by offering the benefit of limited liability. It also offers lower tax rate, ownership transferability, better access to capital and grants and corporate name protection.

Timeline: 2 business hours (named or numbered company).

A corporation is a legal entity that keeps the business owner separate by offering the benefit of limited liability. It also offers lower tax rate, ownership transferability, better access to capital and grants and corporate name protection.

Timeline: numbered company in 2 hours, named company 1 day.

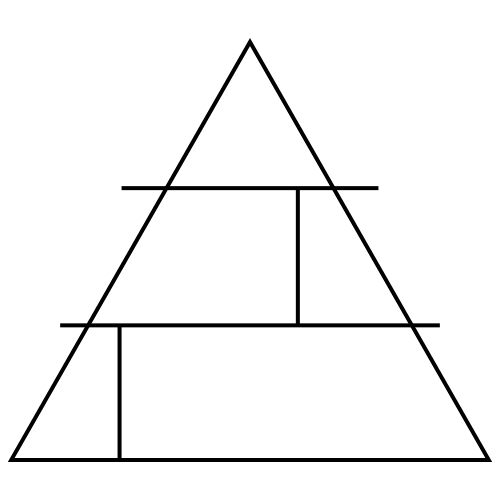

Fill out our website form step by step and place order with Credit Card, PayPal or e-transfer.

Let our registry agent clear the payment, review your order and file with the Governmental unit.

Check your inbox and receive the final documents. You are all set.

1

Fill out our website form step by step and place order with Credit Card, PayPal or e-transfer.

2

Let our registry agent clear the payment, review your order and file with the Governmental unit.

3

Check your inbox and receive the final documents. You are all set.

Being one of the reputable companies, Corporations Ontario incorporates and registers businesses. We pride in being scrupulous in all our incorporation and business registration services. Corporations Ontario’s team of incorporation specialists carefully reviews your submitted forms for an accurate and compliant incorporation process.

CO - Corporations Ontario Registry takes pride in giving personalized attention to our clients. At Corporations Ontario, our competent and efficient team of experts treats your business with extreme care and professionalism. Be it your questions or the need for guidance, directly consult our experts via phone, live chat, or email. Your success is what we are here for. Connect with Corporations Ontario now!

CO understands the difficulty of getting a new entrepreneur on his way. That is why we've tried to make our pricing reasonable and within reach of each group. We, therefore, believe that setup costs shouldn't stand in your way of achieving your business dreams.

At Corporations Ontario we are pleased to offer Ontario express and super express incorporation service. Our processing is rapid with a team of experts as the files are prepared in less than 2 hours from the time the order is placed, and you will have your fully incorporated company documents ready in just about 2 hours.

Let’s Get Started

Protect your brand! Whether it’s a logo, music, or software, our experts specialize in copyright and trademark registration. Gain exclusive rights to your creations and secure your brand’s future!

Let us be your local attorney or agent for service - it is needed for a business set up by the non-residents, extra-provincial registration. We also provide a registered office address and a mail scanning service.

Try our Comprehensive Contract Services! Whether it’s a Partnership Agreement, Shareholder Agreement, or Employment Contract, we’ve got you covered. Trust us to safeguard your business with precision and professionalism.

Efficient accounting solutions for small businesses! Available services include GST/HST filings, tax preparation, payroll services, and more. Let us handle the numbers while you focus on growing your business!

Empower your digital presence: from the domain registration and IT solutions to crafting captivating logos. Need a Google Profile? We’ve got you covered. Let us elevate your brand in the digital world.

Explore our premium selection of the corporate essentials, including Minute Books, official corporate Seals, and elegant Share Certificates. Trust us for professional, high-quality business supplies that leave a lasting impression.

🔍 Trusted & Experienced

Incorporation Ontario takes pride in its thorough and compliant review process, ensuring every detail of your business formation is accurate and error-free.

🌟 Empowering Entrepreneurs

Choosing Incorporation Ontario means more than just a service—it’s a blend of flexibility and expert support. You get the independence of a DIY approach with the confidence of having professional guidance when needed. We offer an affordable, comprehensive, and human-centered solution for today’s entrepreneurs.

👥 Personalized Attention

At Incorporation Ontario, every client receives dedicated attention. Our team brings professional care to your business, offering support through phone, live chat, or email. Your success is our priority.

⚡ Super Express Service

Experience our rapid incorporation services. Our experts aim to complete your filing in as little as two business hours—often even faster—delivering your incorporation documents in record time.

💲 Affordable Pricing

We understand the financial challenges of new entrepreneurs and have designed an affordable pricing structure to ensure cost isn’t a barrier to your business goals. At Incorporation Ontario, we offer a cost-effective solution for all your incorporation needs.

Here’s a rephrased version:

We’ll have your Ontario business incorporated in no time—just 30 MINUTES!

Selecting a Business Name:

Your business name must be unique and distinguishable from other registered names in Ontario. You can either choose a custom name or have the government assign a numbered name. If you’re registering a named corporation, a NUANS report is required (available through our incorporation packages). Note that some incorporation types have specific naming rules. If any issues arise with your proposed name, we will provide guidance and suggest alternative options that meet the requirements.

Roles of Incorporators, Directors, Officers, and Shareholders:

When incorporating a business, you must define the individuals who will serve as directors, officers, and shareholders, along with their respective roles. At least one individual is required to act as an incorporator, director, and shareholder—one person can hold all three positions. Officers are considered employees of the corporation. For Not-For-Profit organizations and Co-Operatives, a minimum of three directors is mandatory.

Registered Office Address:

Every business must have a registered office address, which can be a commercial or residential location. If you don’t have an accessible address in Ontario, you can use our Address & Mail Forwarding Service for registration purposes.

Initial Return Filing:

All Ontario corporations are required to file their initial return within 60 days of incorporation. Failure to do so will result in the corporation being marked as non-compliant in the corporate registry, which could lead to government dissolution of the business.

No, there are no residency requirements to incorporate in Ontario. Directors can reside in either domestic or foreign jurisdictions. Incorporators must be individuals or registered businesses within Ontario.

The key distinction lies in their primary objectives and how they manage profits:

For-Profit Organizations:

These businesses are created with the primary goal of generating profits for their owners or shareholders. Their focus is typically on earning revenue through the sale of goods or services, rather than prioritizing community or societal benefits.

Not-For-Profit Organizations:

These organizations are established to achieve specific organizational objectives, rather than to make a profit. Their operations often focus on social welfare, civic improvement, sports, recreation, or other non-commercial purposes. Unlike for-profit businesses, they don’t have shareholders or owners who receive dividends or profit distributions.

In simple terms: An operating company runs a business by performing day-to-day activities, while a holding company owns and manages investments without actively participating in business operations.

Asset Protection and Risk Mitigation:

A holding company structure acts as a safeguard by protecting the assets of active businesses from potential creditor claims or legal disputes.

Tax Optimization:

Holding companies offer various tax benefits, including income splitting, capital gains exemptions, and tax-deferred transfers of dividends between companies.

Greater Business Flexibility and Control:

Having a holding company with multiple subsidiaries allows for more efficient management, providing greater control and adaptability in business operations.

Succession Planning and Wealth Management:

Holding companies play a crucial role in ensuring a seamless transfer of assets and wealth to future generations, making them valuable for long-term family and business planning.

Tax Deferral and Reduction:

Holding companies can help reduce or delay corporate taxes through strategic financial arrangements.

Access to Low-Interest Loans:

These companies can facilitate low-interest financing options for subsidiaries, along with discreet and cost-effective purchasing opportunities.

In Ontario, regulated professionals such as doctors, lawyers, and other licensed practitioners have the option to form a professional corporation. These corporations must comply with specific guidelines set by their respective regulatory bodies during both formation and ongoing operations. It’s important to note that incorporating as a professional corporation does not shield individuals from personal liability for malpractice; professionals remain personally accountable for their actions. Although the corporation’s activities are limited to practicing the profession, it can also perform tasks that are directly related to its practice. There are key differences between professional corporations and standard business corporations, particularly in terms of their structure, activities, and liability.

A Personal Real Estate Corporation (PREC) is a business structure that allows real estate professionals in Ontario to conduct their business through a corporation. The real estate professional becomes the “controlling shareholder,” which grants them authority over the corporation’s operations and decision-making.

Advantages of a PREC:

Forming a PREC can offer financial benefits, such as increased flexibility in managing income, which may result in tax savings. However, the extent of these benefits depends on the specific financial situation of the individual.

Purpose and Role of a PREC:

A PREC’s primary function is to provide real estate services on behalf of a licensed brokerage. It acts as an extension of the real estate professional, facilitating transactions through the brokerage. It’s important to note that a PREC cannot function independently as a brokerage and must operate within the licensing framework.

Cooperatives are unique business organizations in which ownership and operations are managed collectively by their members. They are founded on democratic principles, ensuring that each member has an equal voice in decision-making, regardless of their financial investment. Cooperatives are formed to serve a variety of purposes, including consumer services, producer support, community development, education, sustainability, and technological innovation. The specific function of a cooperative is determined by the shared goals and needs of its members.

A well-known example is Mountain Equipment Co-op (MEC), a retail cooperative specializing in outdoor gear and clothing. MEC operates exclusively for its members, providing them with quality products while fostering a community-focused business model.

We provide three types of post-incorporation and ongoing maintenance services to support your business.

Please explore our packages for Business Registry by Non-Residents to find the best solution for your needs.